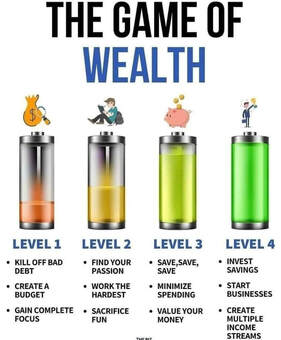

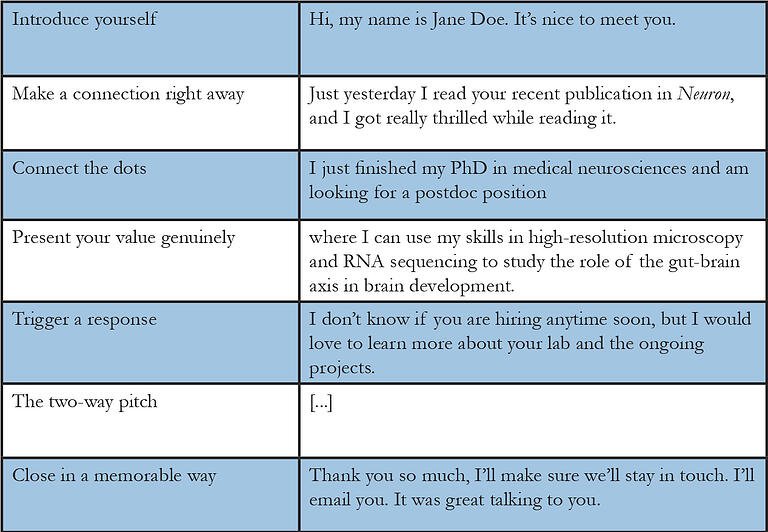

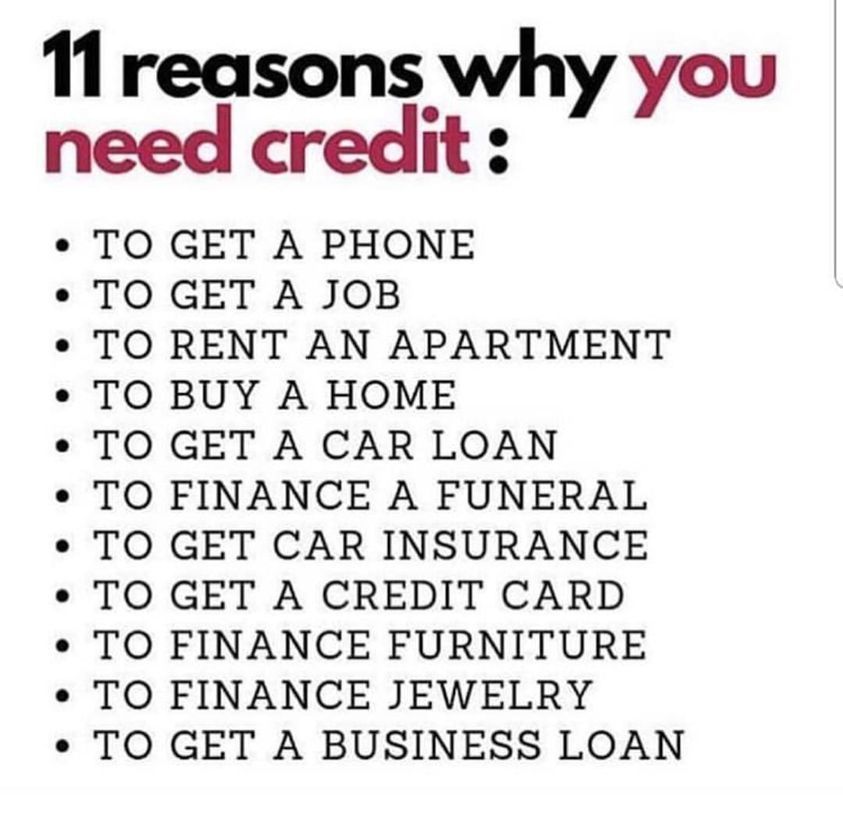

Single Adult -- get a job and mentor, create a vision board of goals/dreams, new car, start life and disability insurance, start IRA or business, establish credit rating, complete education in area of interests, start emergency savings fund, hobby, social activities ....and create a sample budget

Get Insurance, Job, and Start Savings

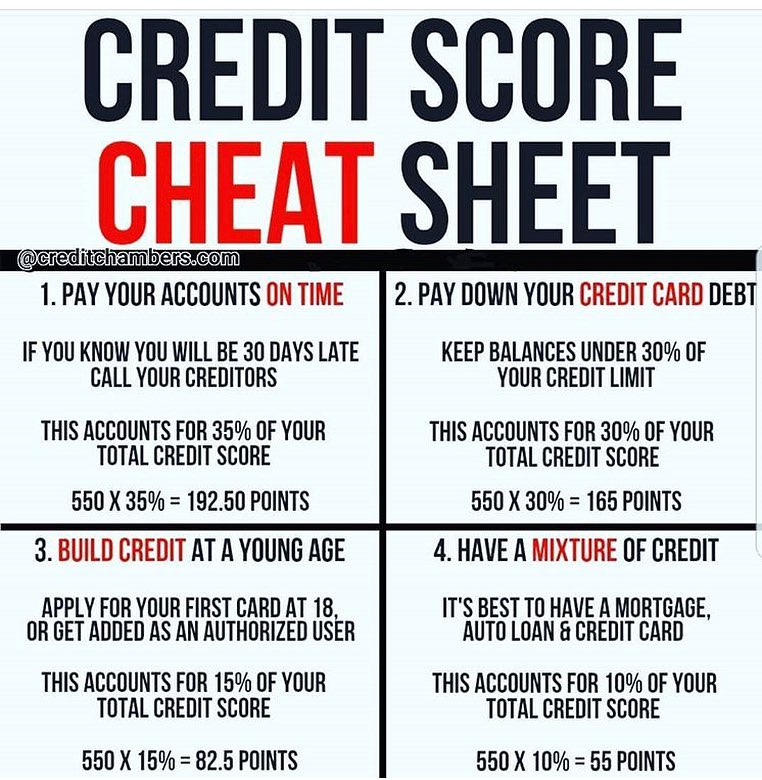

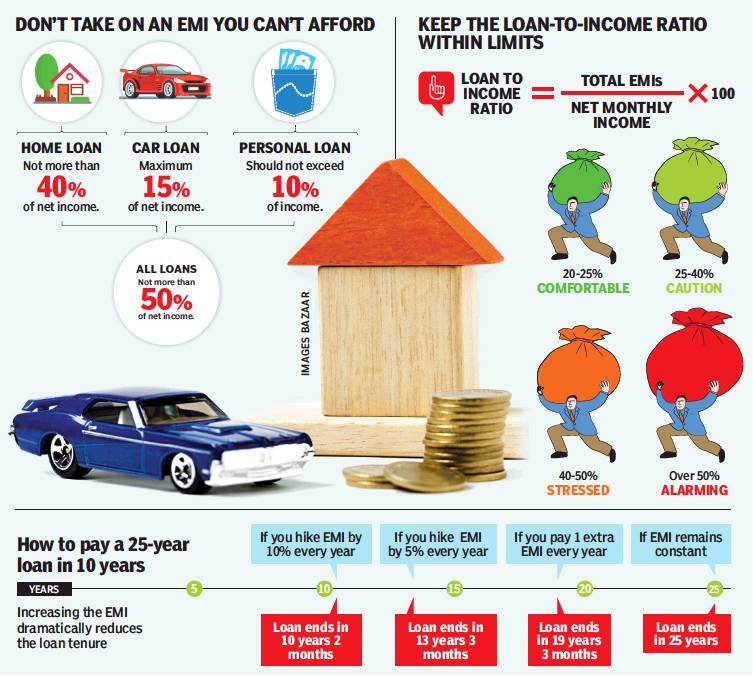

Home monthly payment -- 35% take-home pay (or less)

Car monthly payment -- 15% take-home pay (or less)

Tip:

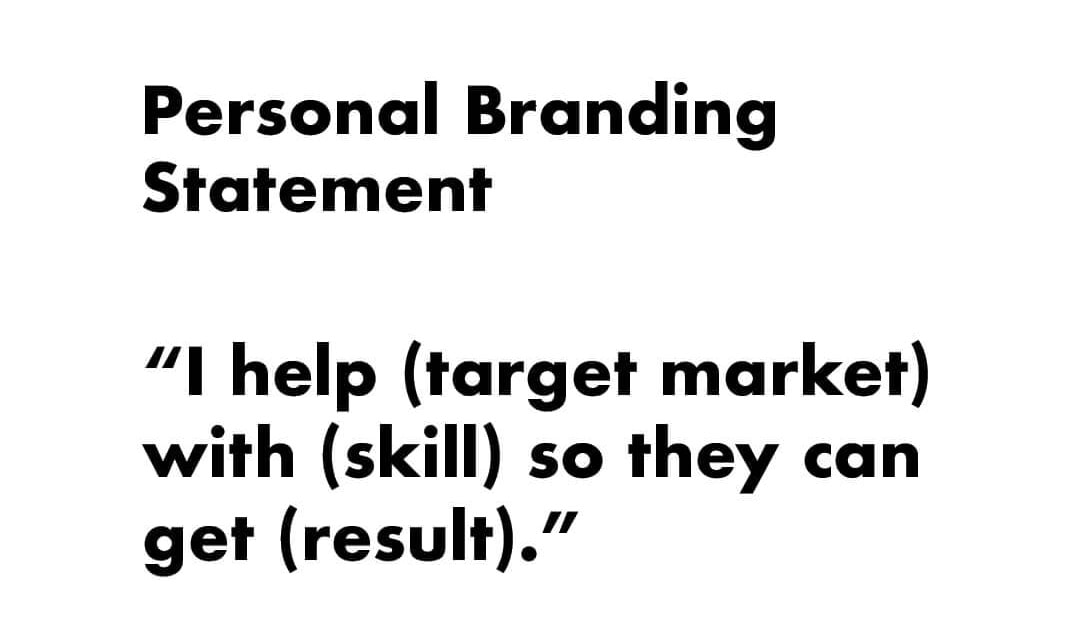

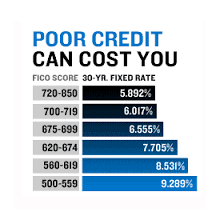

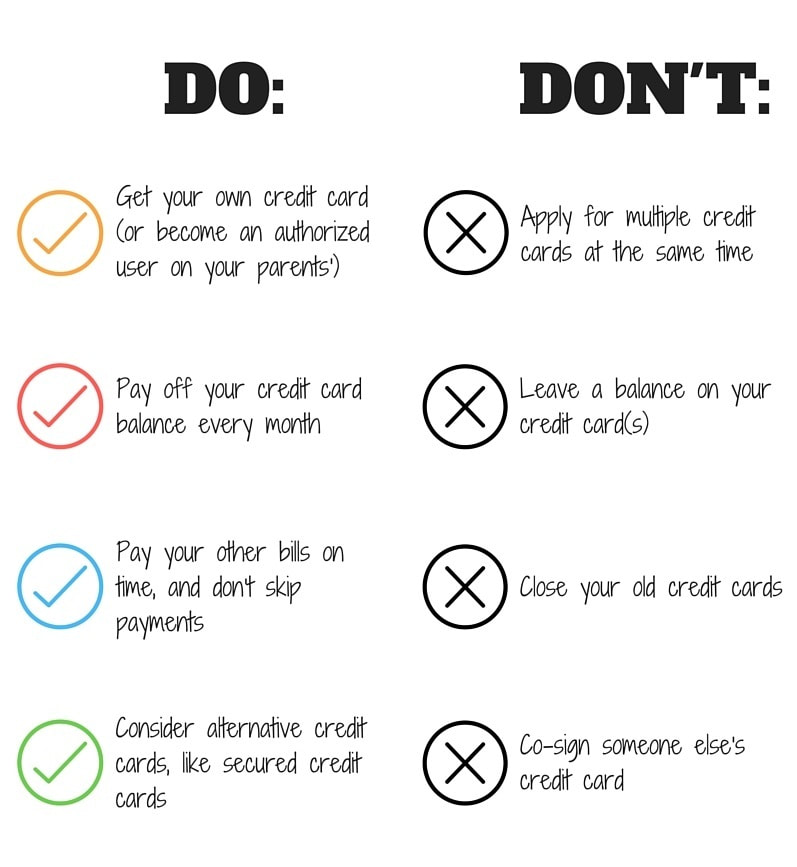

Before making major purchases check your credit score, if low, try to raise it by 50 - 100 points

Lower College/Trade School Debt

Ways to go BROKE - Have fun but control your spending

Young Married – create a vision board of goals/dreams, get a marriage/career mentor, small house, condo, adequate flood, life and health insurance, start IRA, bigger car, emergency savings fund ....and create a sample budget

Start Savings and Purchase Disability and Life Insurance

Ways to go BROKE - Have fun but control your spending

Parenthood – education fund for kids, larger home, vision board of family dreams/goals, emergency fund, day care, vacations, IRA or small business ownership

Plan for Kids College and Your Retirement

Parent Older Kids – make plans for retirement, disburse education funds, may take care of parents, kids activities, a major illness (disability) ..

Financially Squeezed - Juggling parents aging, kids, health and career

Empty Nest - smaller house(paid off), kids gone, pursue dreams, roll IRA into Fixed Annuity

Pay for kids college, stuck in dead end jobs

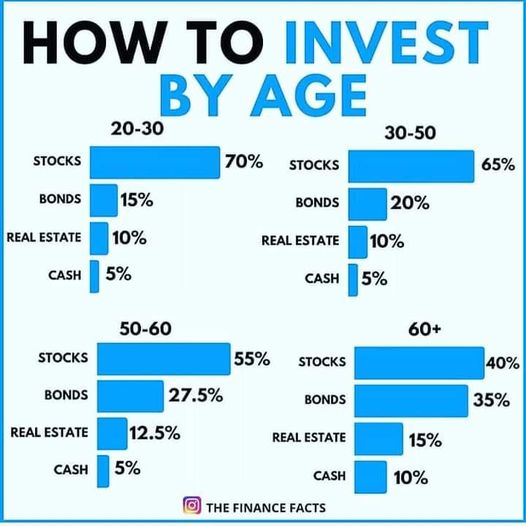

Retirement - Fixed Annuity (Secure Income & no debt), travel, volunteer in organizations that you would like to leave a legacy of service and funding.. Compound Annual Growth Rate (CAGR), shows 10.04% average S&P 500 return from 1928 to 2020 .....invest in index funds at work.

Retirement Benefits

Emergencies -- Unexpected financial or medical tragedy or disaster Local Social Services

Tip: 3 to 6 months of savings in cash, helps to pay for unexpected expenses (repairs, etc)

Why? To avoid the high interest rate pay day and title loans when in a 'crisis'.

A. Save $5 - 20 a week to build a 3 to 6 months reserve...in a savings account, you 'spend and replace' funds in this account as needed for 'unexpected expenses'(keeping between $1,000 - $5,000 in emergency funds is a good idea). Build a emergency fund first, then move to investments, etc.

1. Purchasing home warranties for major appliances may reduce cost of repairs

2. Purchasing warranties on major car parts may reduce cost of repairs

Disability Benefits - Life happens to everyone, short term or long term illness that prevent you from working for a period of time. How to apply for Disability

Unemployment Benefits - Life happens to everyone, contract ends, jobs terminate, and layoffs happen that prevent you from working for a period of time. Unemployment Benefits

Burial - Life Insurance cover expenses left behind, try to leave more than just your last name behind

Things to do when loved one dies

Final financial wisdom: Create a will to distribute your possessions to the causes and people you would love to help

Inheriting money after a loved one dies.

Widows Benefit

Tip:

Use coupons to 'stretch your money farther' in the month. coupons

Always look for deep discounts ......

there's always a 'sale' somewhere for what you want.

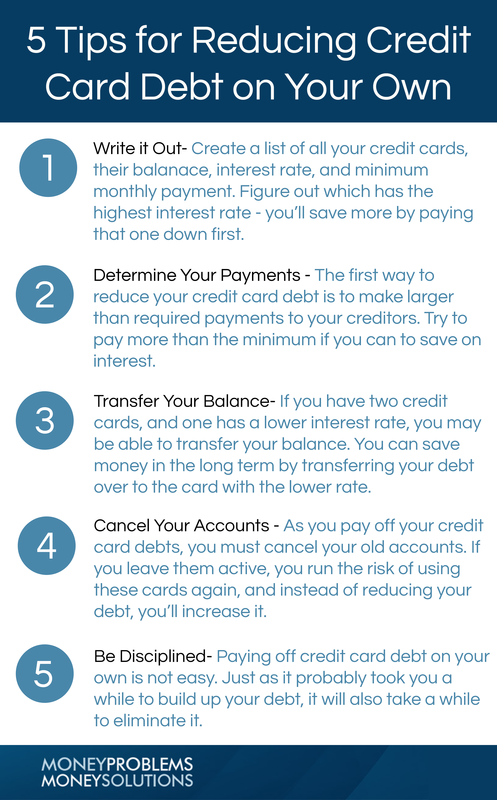

Use only 30% of total credit card balances when making purchases, keep 2 cards.

File and Store Household record keeping about purchases, taxes and documents

Ways to go BROKE - Have fun but control your spending

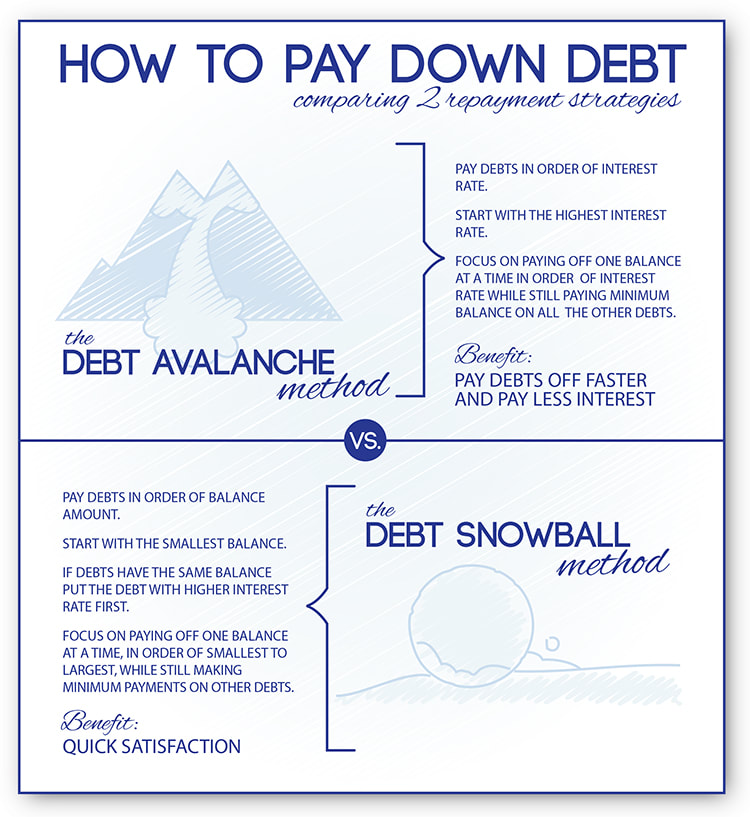

Make it a goal to be free of debt by the time you expect to retire. Choose a home loan, vehicle loans that you payoff during your working years. If you are worried about bills, you can’t enjoy retirement, by doing what you and only you want to ....whatever that is!

Delaying Car New Purchases

Eliminating Household Debts

Starting a Business.....Wonder and Ponder the question, What business idea, can i financially live on for a lifetime? Small Business Resources

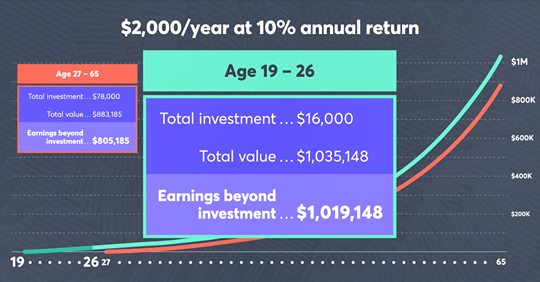

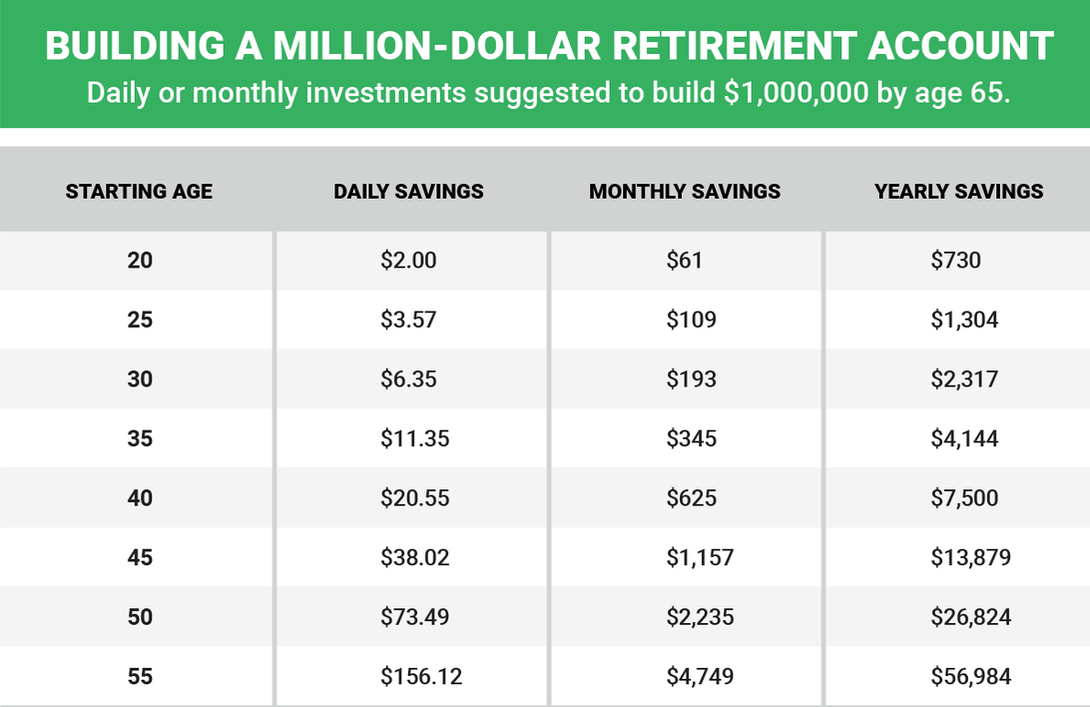

Putting money in 401K at work.....Warren Buffet states, 'Put the money in a low-cost S&P 500 index fund and forget moving it around' ...the return is greater and the fees are less over time (you make more money)

Put $10 - $35 weekly into a 401K, invested into S&P index fund (10% interest), from age 20 - 65, may allow you to have $1 million dollars in retirement. If you change jobs, a rollover IRA will allow you to do the samething. Of course, if your company matches your money, take advantage of that increase in deposits, as well.

Broke-to-Better blogs, Nomopofolks Association, Dallas, Texas

Get Insurance, Job, and Start Savings

Home monthly payment -- 35% take-home pay (or less)

Car monthly payment -- 15% take-home pay (or less)

Tip:

Before making major purchases check your credit score, if low, try to raise it by 50 - 100 points

Lower College/Trade School Debt

Ways to go BROKE - Have fun but control your spending

Young Married – create a vision board of goals/dreams, get a marriage/career mentor, small house, condo, adequate flood, life and health insurance, start IRA, bigger car, emergency savings fund ....and create a sample budget

Start Savings and Purchase Disability and Life Insurance

Ways to go BROKE - Have fun but control your spending

Parenthood – education fund for kids, larger home, vision board of family dreams/goals, emergency fund, day care, vacations, IRA or small business ownership

Plan for Kids College and Your Retirement

Parent Older Kids – make plans for retirement, disburse education funds, may take care of parents, kids activities, a major illness (disability) ..

Financially Squeezed - Juggling parents aging, kids, health and career

Empty Nest - smaller house(paid off), kids gone, pursue dreams, roll IRA into Fixed Annuity

Pay for kids college, stuck in dead end jobs

Retirement - Fixed Annuity (Secure Income & no debt), travel, volunteer in organizations that you would like to leave a legacy of service and funding.. Compound Annual Growth Rate (CAGR), shows 10.04% average S&P 500 return from 1928 to 2020 .....invest in index funds at work.

Retirement Benefits

Emergencies -- Unexpected financial or medical tragedy or disaster Local Social Services

Tip: 3 to 6 months of savings in cash, helps to pay for unexpected expenses (repairs, etc)

Why? To avoid the high interest rate pay day and title loans when in a 'crisis'.

A. Save $5 - 20 a week to build a 3 to 6 months reserve...in a savings account, you 'spend and replace' funds in this account as needed for 'unexpected expenses'(keeping between $1,000 - $5,000 in emergency funds is a good idea). Build a emergency fund first, then move to investments, etc.

1. Purchasing home warranties for major appliances may reduce cost of repairs

2. Purchasing warranties on major car parts may reduce cost of repairs

Disability Benefits - Life happens to everyone, short term or long term illness that prevent you from working for a period of time. How to apply for Disability

Unemployment Benefits - Life happens to everyone, contract ends, jobs terminate, and layoffs happen that prevent you from working for a period of time. Unemployment Benefits

Burial - Life Insurance cover expenses left behind, try to leave more than just your last name behind

Things to do when loved one dies

Final financial wisdom: Create a will to distribute your possessions to the causes and people you would love to help

Inheriting money after a loved one dies.

Widows Benefit

- Take about 70% of the money to pay down outstanding debts (credit cards, mortgage) and add money to your 'rainy day' savings account, if you have no debt place money into safe investments that grow your money

- Plan to 'blow' about 20% of the money on self and family(clothes,vacations,upgrades, etc)

- Split the other 10% between an investment that is making money that you don't have to worry about and donating to a charity that honors the loved ones life...if it was not included in the will

Tip:

Use coupons to 'stretch your money farther' in the month. coupons

Always look for deep discounts ......

there's always a 'sale' somewhere for what you want.

Use only 30% of total credit card balances when making purchases, keep 2 cards.

File and Store Household record keeping about purchases, taxes and documents

Ways to go BROKE - Have fun but control your spending

Make it a goal to be free of debt by the time you expect to retire. Choose a home loan, vehicle loans that you payoff during your working years. If you are worried about bills, you can’t enjoy retirement, by doing what you and only you want to ....whatever that is!

Delaying Car New Purchases

Eliminating Household Debts

Starting a Business.....Wonder and Ponder the question, What business idea, can i financially live on for a lifetime? Small Business Resources

Putting money in 401K at work.....Warren Buffet states, 'Put the money in a low-cost S&P 500 index fund and forget moving it around' ...the return is greater and the fees are less over time (you make more money)

Put $10 - $35 weekly into a 401K, invested into S&P index fund (10% interest), from age 20 - 65, may allow you to have $1 million dollars in retirement. If you change jobs, a rollover IRA will allow you to do the samething. Of course, if your company matches your money, take advantage of that increase in deposits, as well.

Broke-to-Better blogs, Nomopofolks Association, Dallas, Texas

RSS Feed

RSS Feed