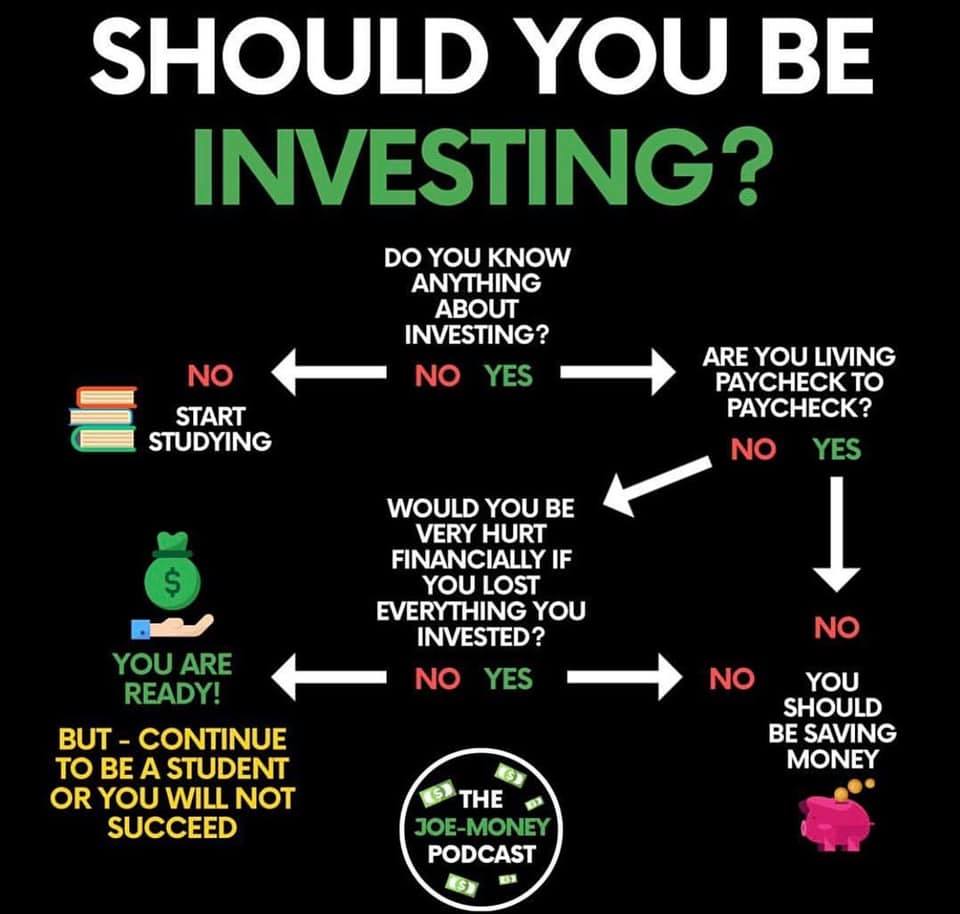

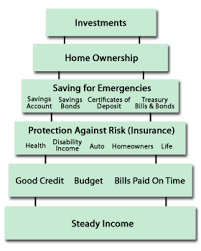

Steps before you Invest

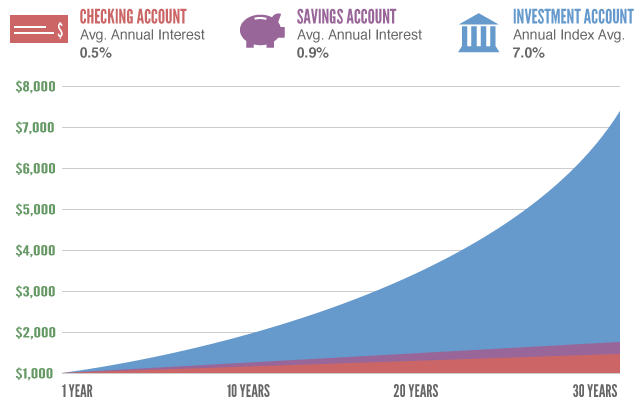

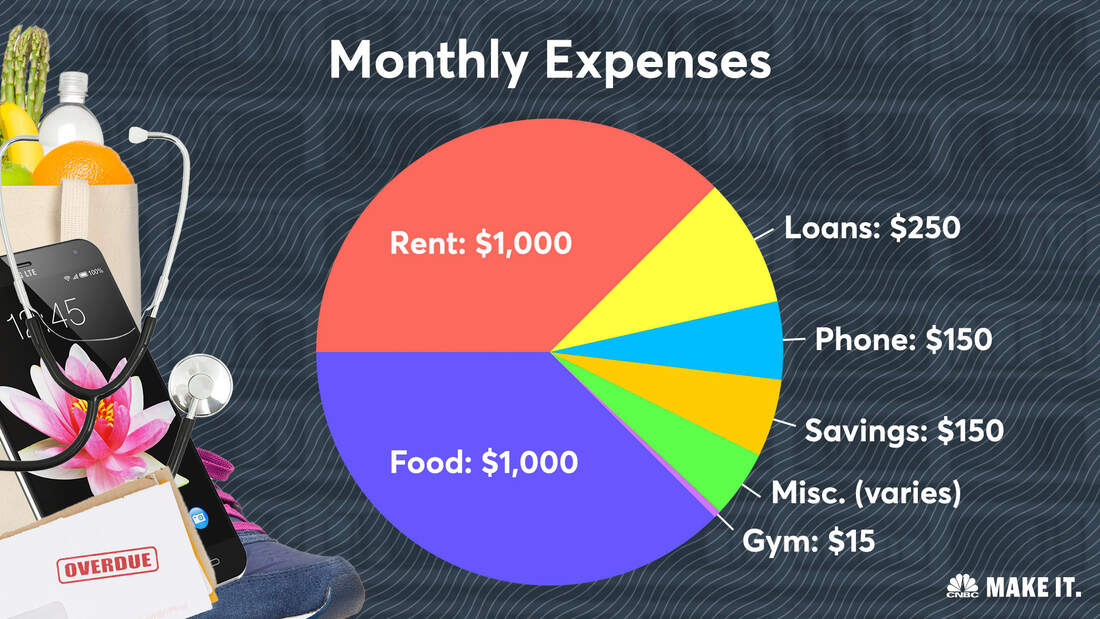

Amount to Invest

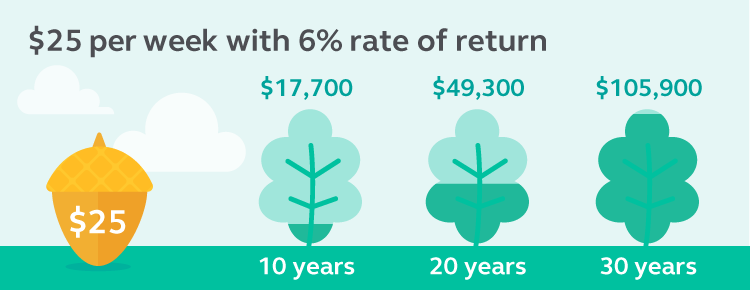

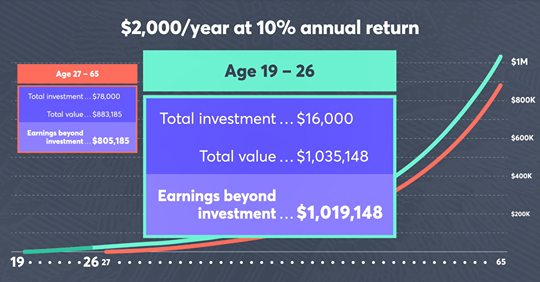

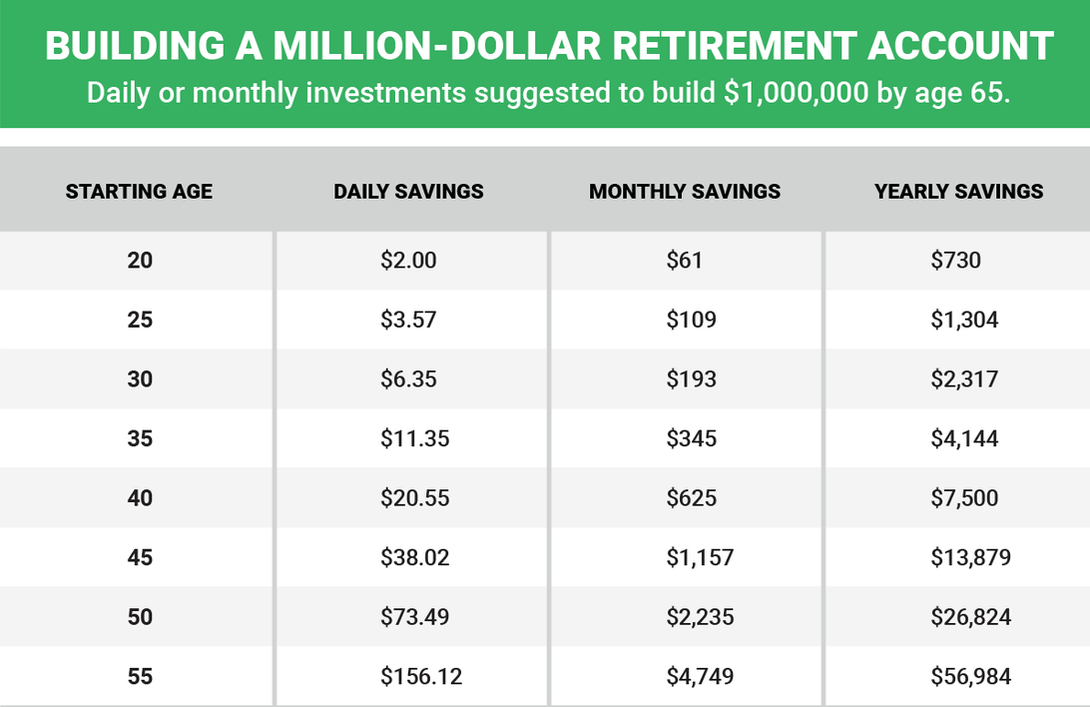

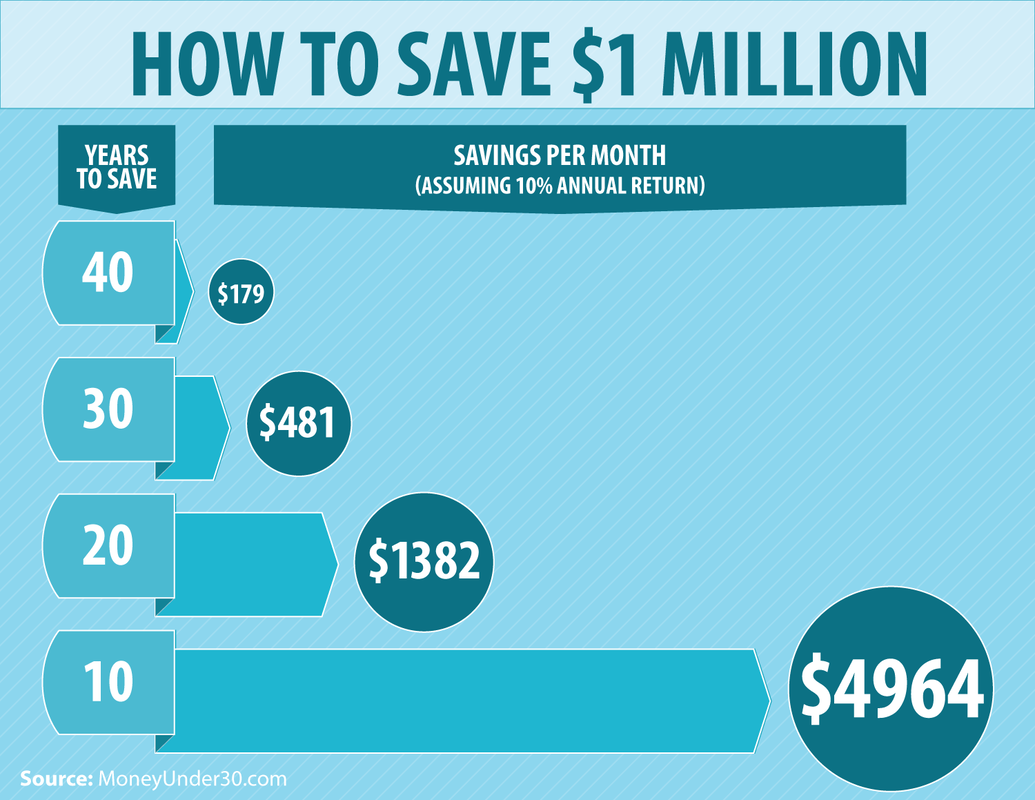

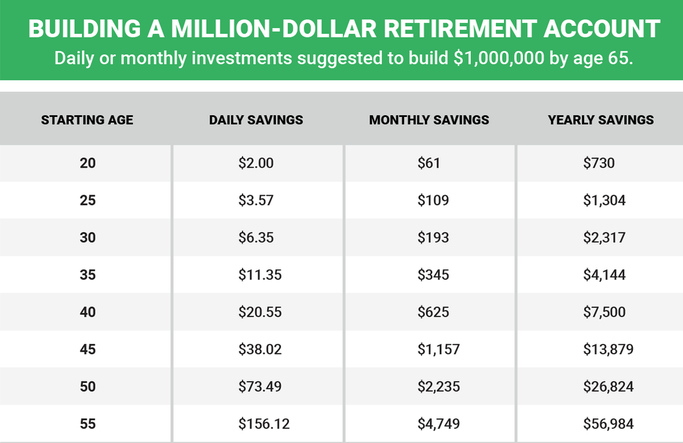

Invest $42 week at 10% interest, work 10years = $1 million dollar

Compound Annual Growth Rate (CAGR), shows 10.04% average S&P 500 return from 1928 to 2020.

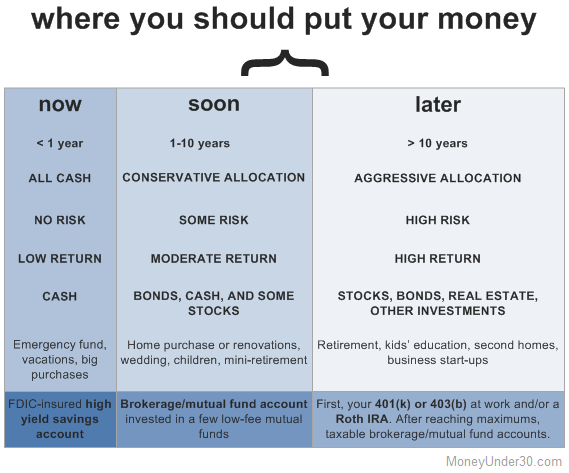

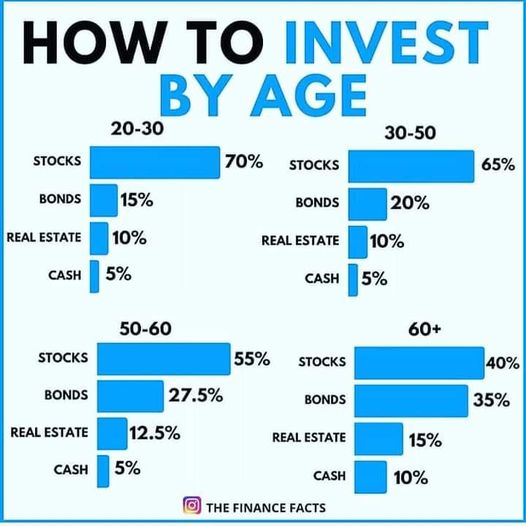

Where to Invest

Best recommended........ Pick Market Leading Growth Companies by Industry (stocks)

_______________________________________________________________________________________________________

Best recommended strategy long term.....Buy and Hold in S&P 500 index mutual funds

_______________________________________________________________________________________________________

Best recommended strategy long term.....Buy and Hold in S&P 500 index mutual funds

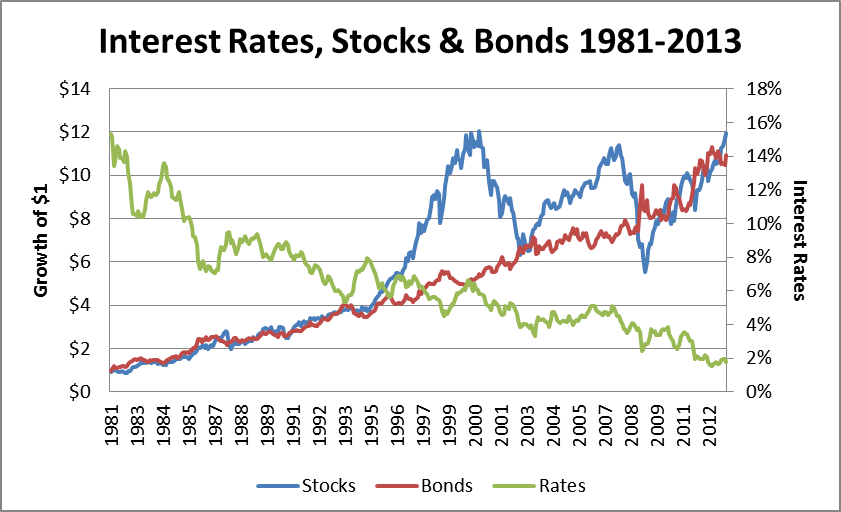

Historically, if interest rates are low, stocks and bond returns are high (no CD's)

and if interest rates are rising up may mean move to cash (CD's)

and if interest rates are rising up may mean move to cash (CD's)

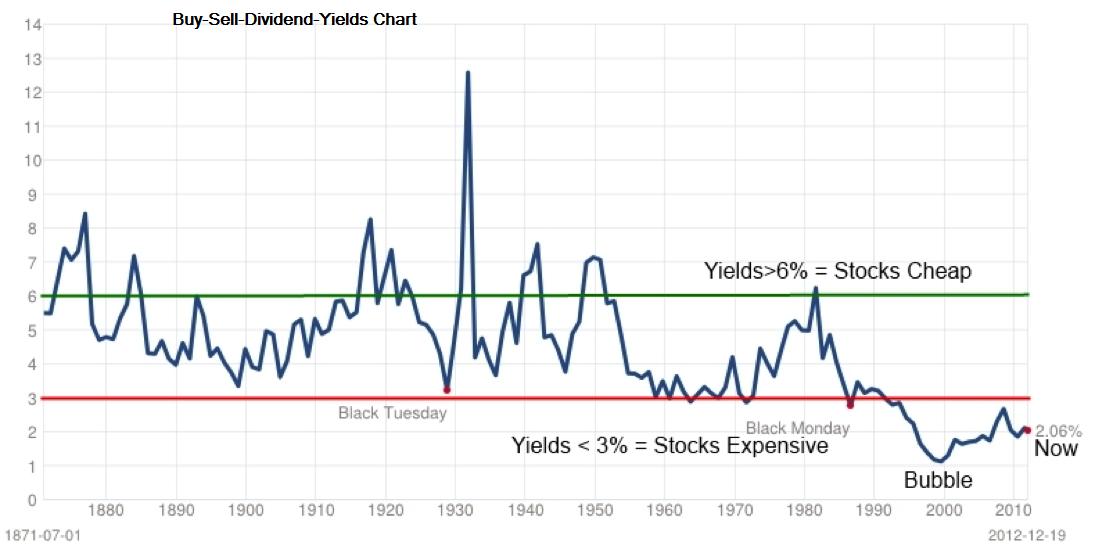

Historically if dividends < 3 means stock are expensive,

if yields > 6 stock market stocks are cheap to buy

....purchasing yields between 4 - 7 has been profitable long term for most investors

if yields > 6 stock market stocks are cheap to buy

....purchasing yields between 4 - 7 has been profitable long term for most investors

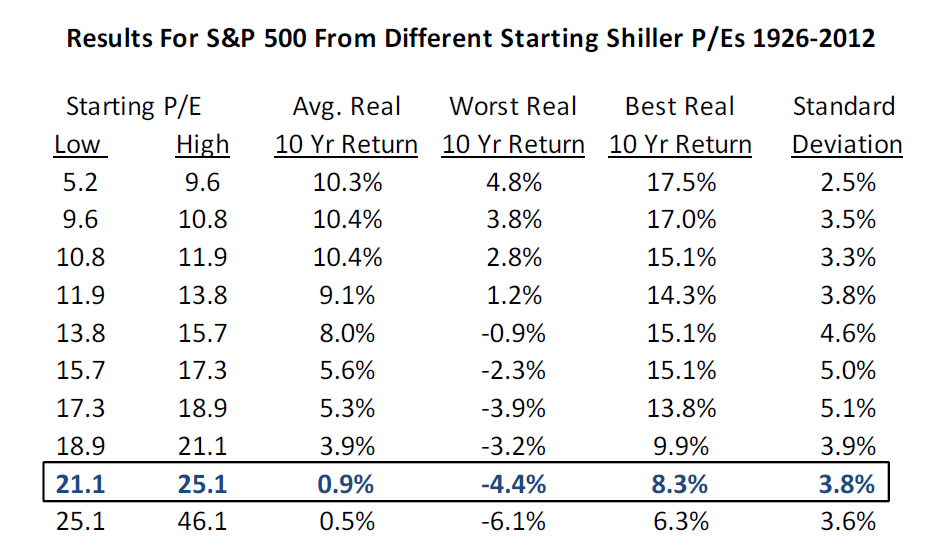

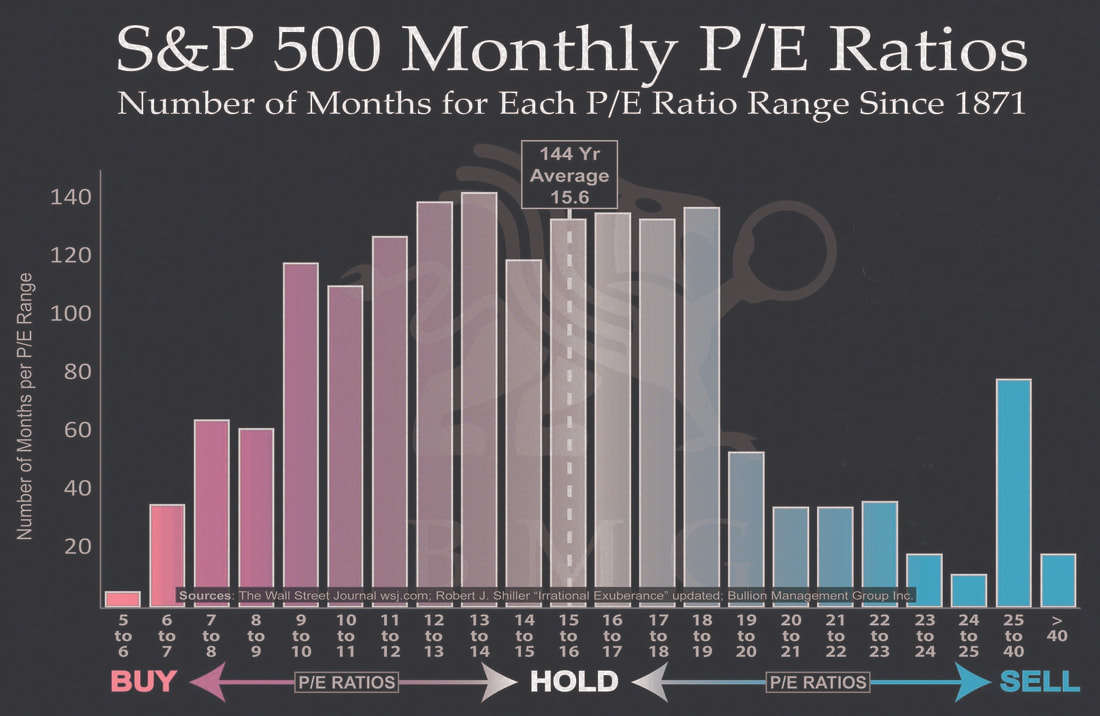

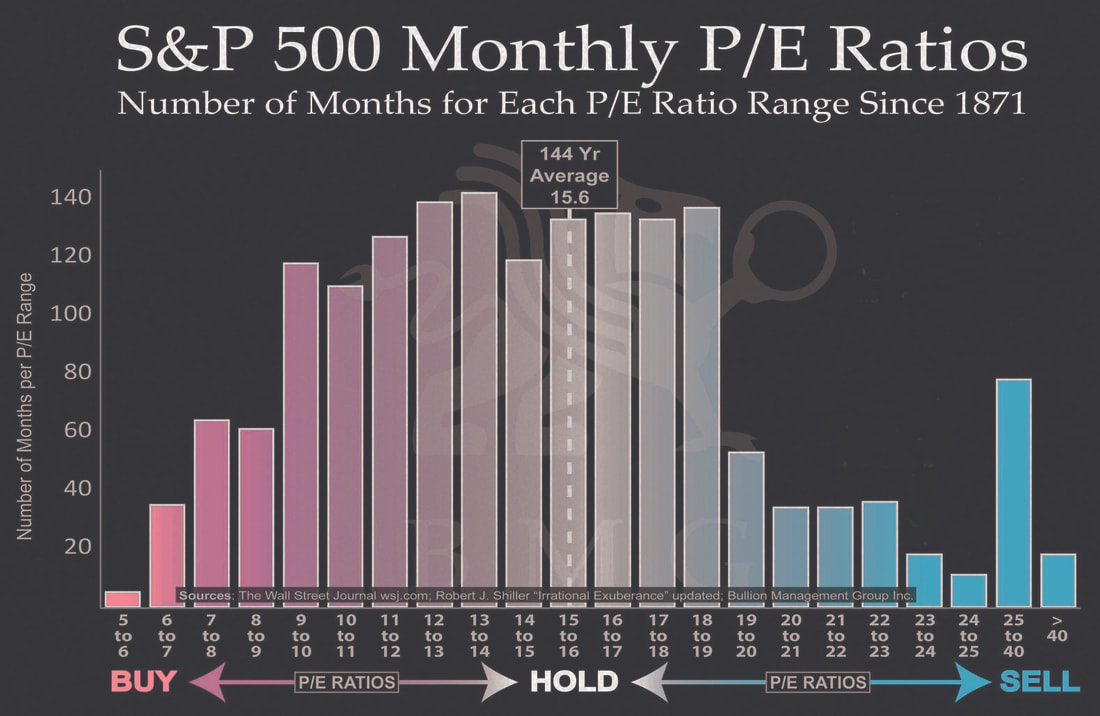

Note: if a stock has p/e > 25.....may mean stock price is to high...move to cash or low p/e stock

Note: buy (low) if your stock p/e > 4...rising to..... p/e stock > 26....sell (high)

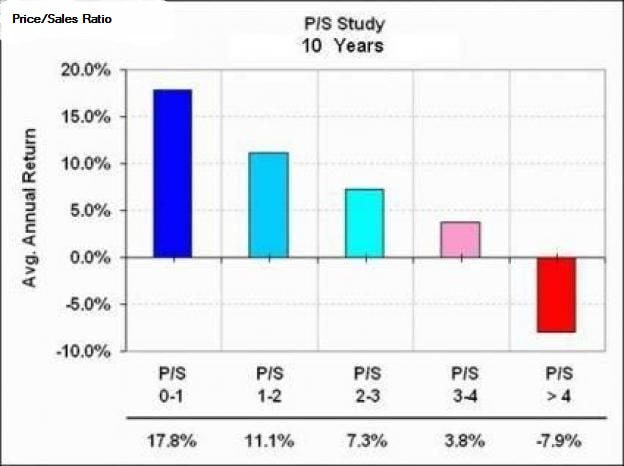

Historically if a stock price/sales fundamental is rising from 0.25 to 3 it will make money, when your stock or stock market hit p/s > 3 may mean move to cash or to a low p/s stock

RSS Feed

RSS Feed